The 8-Minute Rule for Tax Office Near Me

Table of ContentsThings about Tax Services 76017Indicators on Tax Services 76017 You Should KnowThe 2-Minute Rule for Best Tax Services In Arlington TxIrs 76001 Fundamentals ExplainedThe Tax Services 76017 Statements

For students as well as scholars that are taken into consideration nonresidents for tax obligation purposes, rate of interest revenue is not strained if it comes from a united state bank, a united state savings as well as car loan institution, an U.S. cooperative credit union, or an U.S. insurer. Normally, revenue from foreign resources is not exhausted. Incomes that appear on form W-2 are taxed.If you can not obtain a reimbursement from your employer, use Form 843 Case for Refund as well as Demand for Reduction to ask for a refund from the IRS. Glacier Tax obligation Prep will aid you with this procedure. If you have determined, based on the considerable visibility examination or marital relationship to an U.S.

Begin the procedure utilizing; it must benefit all students or scholars who are nonresidents for tax purposes. Please take care of deceitful frauds and web "phishing" that utilize the IRS name or other tax-related recommendations to get access to your personal details in order to dedicate identification theft.

The Ultimate Guide To Irs 76001

The e-mail requests your Social Safety Number and various other individual information in order to refine the reimbursement. Fake internal revenue service correspondence and also an altered Form W-8BEN, "Certification of Foreign Standing of Beneficial Proprietor for United States Tax Withholding" are sent to nonresident aliens that have actually spent in united state building and also have U.S.

Evaluation our Often Asked Questions about taxes (Tax Office near me).

Tax obligation solutions make up most of the second resources that are available to aid study tax concerns. Additional authorities work when contrasting main authorities exist, when there appears to be no extant primary authority, or when you require an explanation or clarification of the key authority. As you are researching your tax obligation concern you must make sure not to count too heavily upon the secondary authority, and constantly check out any relevant key authority that is referred to in the secondary resources.

These commercial tax solutions work because they usually offer streamlined explanations with afterthought citations, in addition to examples showing the application of the legislation. These tax obligation services Discover More Here might lead you, via the footnote referrals, to the primary resource that concerns the inquiry available. A tax solution can be classified as either an "annotated" service or a "topical" solution.

The Ultimate Guide To Income Tax Near Me

Business Clearing Home (CCH) and also Research Institute of America (RIA) create both significant annotated tax solutions. The topical solutions are arranged by subject, as defined by the publisher's content team. Choose a topic listed here to find out more: (Best Tax Services in Arlington TX).

Below, you will certainly locate information concerning the different taxes for organizations and firms running in Vermont. If you are doing business in Vermont, you are likely topic to one or even more tax obligations depending on your service activities and legal structure. Select a tax type or subject to read more. Virtually all companies that have any type of operations or activity in Vermont are needed to submit a yearly earnings tax obligation additional hints return, the declaring of which usually synchronizes with federal/IRS coverage needs.

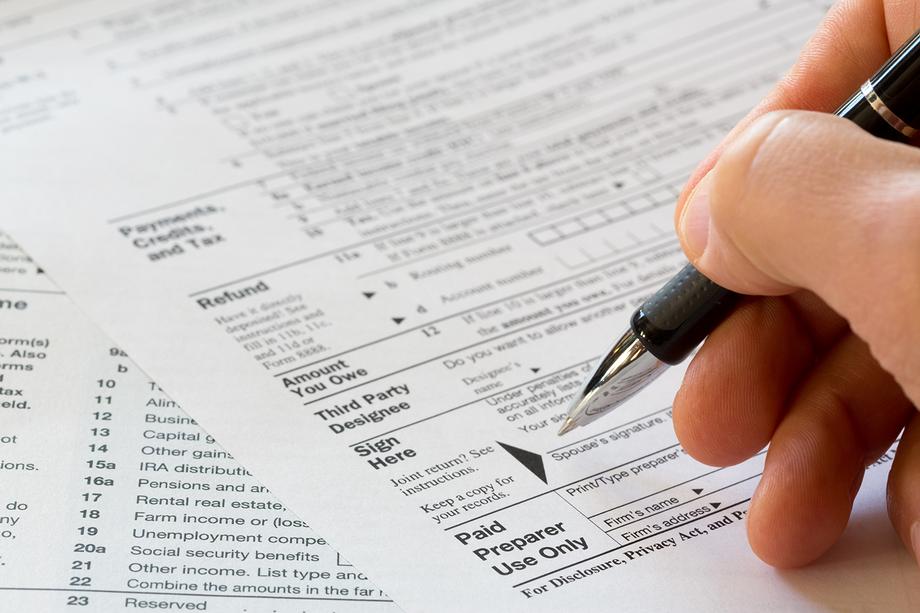

OR Find a tax specialist you trust to prepare and also e-file your return. Almost all tax obligation preparers utilize e-file now and also several are now required by regulation to e-file.

Indicators on Tax Services 76001 You Need To Know

Specific restrictions use. See the instructions web page of the i-File application for more information.

In my viewpoint, many tax preparers are truthful too, as well as just a couple of pride themselves on acquiring large refunds in illegal ways. This instance offers to caution you to evaluate your return and not to take too much deductions, particularly with raised enforcement by the internal revenue service and also state tax authorities (Affordable Tax Service).

Typically, a CPA will have far better devices and also more understanding to aid you in looking into intricate tax obligation positions, in addition to a bigger knowledge base that they can apply in decreasing your tax obligation responsibility, within the limits of the tax obligation code. CPAs are typically extra concerned with performing top quality work, as opposed to large amount.

The Ultimate Guide To Irs Tax Preparer

A number of customers we have actually met with in the previous a number of years have only had earnings from employment wages (W-2 kind); which would certainly result in a tax return that our company can not supply any additional expertise in the prep work of, while also billing a greater charge for the very same end result.